Did you know that a staggering 75% of shippers have experienced the nightmare of lost or damaged packages in the past two years? But here’s what’s even scarier: replacing those damaged or lost orders can cost up to 17 times more than the original shipping.

And it’s not just the financial losses that can hurt your business. 41% of consumers report a negative impact on a brand’s image when their orders are lost, delayed, or arrive in poor condition.

As an experienced e-commerce business, you’re probably no stranger to the frustrating hours spent grappling with carrier claims.

That’s why being prepared is crucial, and shipping insurance is your much-needed safety net.

In this article, we’ll provide a comprehensive overview of shipping insurance. Discover what it is, explore its benefits, and learn why it’s an absolute necessity for your online store.

- What is shipping insurance?

- Does your business need shipping insurance?

- Carrier coverage vs third-party shipping insurance: the main benefits

- Where to get shipping insurance?

- How does Sendcloud Shipment Protection work?

What is shipping insurance?

Shipping insurance is your package’s superhero cape, safe-guarding against mishaps during transit and eliminating the financial damage caused by lost, damaged, or stolen packages. The amount you will get back will depend on the terms of the coverage you choose.

Some carriers include insurance with their shipping services, but this can be limited or only included with premium options. Shipping insurance offered by third-party providers generally has broader coverage. We’ll dive into both of these options later on in the article.

Does your business need shipping insurance?

In short… yes! It’s a very wise idea to have some cover on the packages you ship.

But the key question is: do you need additional shipping insurance, or is the cover included from a carrier enough when insurance is included?

Shipping insurance is a must-have if you’re doing any of the following:

- Shipping high-value, fragile, or easy-to-lose items

- Shipping unique or irreplaceable items

- Shipping high volumes of packages: With higher volumes comes an increased risk of encountering issues, particularly during peak shipping times when carriers get inundated

- Shipping Internationally: Dealing with international claims is a pain in the backside that can only be avoided with the right insurance

However, if you’re a small business whose average shipment value is less than £30-50, it might not be necessary to purchase extra shipping insurance.

Many domestic and international carriers cover a certain value with some or all of their shipping services.

If you choose to not add extra insurance, make sure to check out the coverage and terms and conditions of different carriers, and see which will best fit your needs.

But wait, if carriers include coverage with their shipping, what’s the point of adding additional shipping insurance?

Carrier coverage vs shipping insurance: the main benefits of shipping insurance

Unfortunately, carrier insurance can be very limited, including long lists of non-compensated items, low-value coverage, a slow reimbursement time, and tricky terms and conditions to qualify for compensation.

So let’s take a look at the key benefits of investing in shipping insurance compared to the coverage offered by carriers:

- Financial protection against loss, damage, or theft: The value of coverage carriers generally include is much lower than third-party insurance, while the cost of things like return shipping or reshipping costs are generally not included. With shipping insurance, you are covered for the full sales price, not just the purchase price of an item. With a higher claims value, you’ll have peace of mind knowing that if an item is lost, damaged, or stolen, you won’t have to absorb the full financial impact. The insurance premium offers a more manageable and predictable expense.

- Minimise disputes and claim faster: Unfortunately, claims directly with a carrier take an average of 20 days to complete an investigation, sometimes a lot longer. With shipping insurance in place, disputes and refund requests related to lost or damaged shipments can be resolved quickly and smoothly. The insurance coverage will ensure that you can quickly reimburse customers or provide replacements.

- Improved customers’ experience: With a quick claims process, you can send out the same item again quickly, making sure your customer’s experience isn’t heavily damaged either. Customers feel more secure knowing that their purchases are protected, which can lead to enhanced loyalty and positive reviews.

- Outshine competitors: Providing shipping insurance can help set you apart from your competitors. It becomes an attractive selling point, as customers perceive added value and peace of mind when buying from businesses that prioritize the safety of their orders.

- Minimize the risk of shipping internationally: Shipping abroad comes with increased risks. That means for e-commerce businesses that sell globally, shipping insurance is particularly valuable. It provides protection against the complexities and uncertainties of cross-border transportation, safeguarding the business from potential issues related to customs, regulations, or long transit times.

Where can I find shipping insurance?

If you’re looking for extra coverage beyond what your carrier can offer, then it’s time to dive into the world of shipping insurance providers. Streamlining your e-commerce logistics is vital, and that’s where having your insurance integrated with your shipping platform will keep things easy.

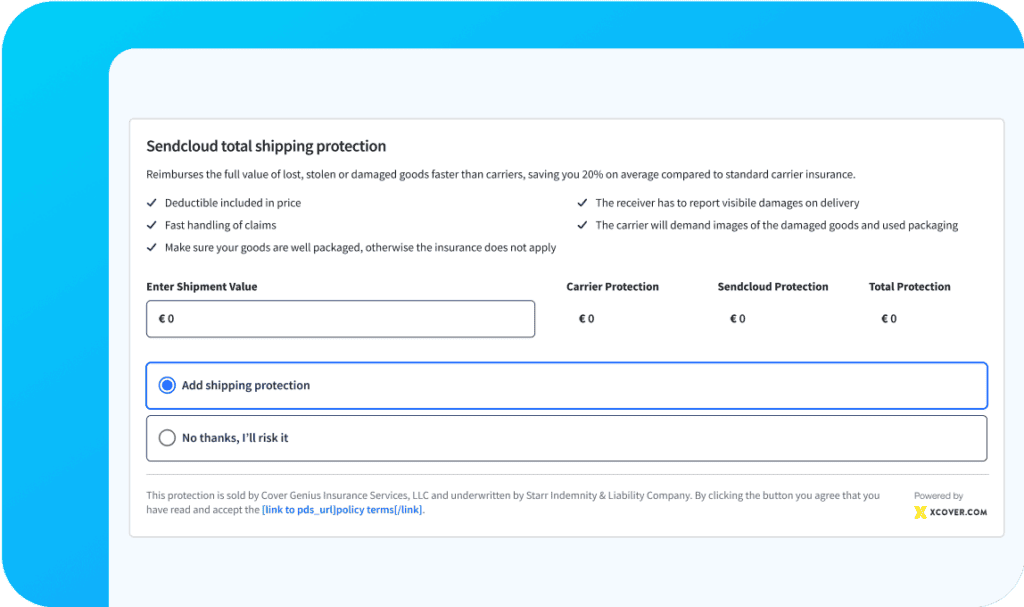

With Sendcloud Shipment Protection, you can seamlessly connect your logistics management with your shipping insurance, offering a solution that is simple and centralised to just one tool.

How does Sendcloud Shipment Protection work?

Sendcloud Shipment Protection covers your shipments for all of the following, for up to €5k, based on the order value (the full sale price and shipping cost):

- If your shipment is damaged during transit, including water damage.

- If your shipment is lost during transit.

- If your shipment is stolen, including package theft (porch piracy).

- Return shipping costs are covered

- Reshipping costs are covered

Unlike most coverage from carriers, Sendcloud Shipment Protection covers the full sales price, not just the purchase price of the item. You’ll also receive compensation for returns and reshipping.

As a Sendcloud user, you’ll be able to easily enable Sendcloud Shipment Protection within your account, ensuring all your shipments are protected from damage, loss, and theft.

Sendcloud Shipment Protection vs Carrier Insurance

With traditional carrier insurance, processing claims and payouts can be slow and require a lot of time and resources.

Sendcloud Shipment Protection aims to illuminate this hassle and create a smooth and fast process to make claiming lost, damaged, or stolen packages a much easier process.

Here’s how:

- Coverage of up to €5k: This includes the full sale price, as well as covering return shipping and reshipping costs. Often, many carriers will only cover the amount it costs to acquire, purchase or manufacture the item.

- Hard-to-cover goods like jewelry and electronics are covered: Many carriers have long lists of items they will not compensate such as jewelry and electronics.

- 1-day claims: Traditional carrier insurance takes 20 days on average to complete an investigation. On average, SendCloud Shipment Protection takes just 1 day. We receive all the required data to process your claim at the time of ordering. When something goes wrong with your parcel, all that’s required is to fill out a quick form. Once passed the approval process, the payment is made instantly into any bank account worldwide.

- No minimum wait times: With Sendcloud Shipment Protection, there are no minimum wait times. Instead of waiting for the completion of carrier investigations, an investigation will be run independently and, backed by AI, quickly determines that the shipment has gone missing.

Stop letting your customers down, and insure your parcels

Adding additional shipping insurance to your orders is a smart and proactive decision, especially when you’re shipping high-value, fragile, or irreplaceable items. While some carriers include insurance coverage, they usually only cover low-value items. By opting for shipping insurance such as Sendcloud Shipment Protection, you provide yourself with a safety net that offers peace of mind and protection against the unexpected.

Looking to add shipping insurance to your parcels? Learn more about Sendcloud Shipment Protection at www.sendcloud.com/shipping-protection.