Is your e-commerce business ready to expand to international shipping? Considering importing or exporting products on the global marketplace? These are all smart ways to grow your online retail business and reach a larger market.

Here’s the catch: your international shipments have to jump over some bureaucratic hurdles. Unlike domestic commercial shipping, which is often more straightforward, international shipping involves getting your shipments cleared by customs authorities at the border.

To make sure your products reach your international customers efficiently and quickly, you’ve got to do everything you can to ensure smooth customs clearance for your shipments. That’s what the Harmonized System Code (HS Code) of tariff codes is all about.

The importance of HS Codes in international shipping

The importance of HS Codes in international shipping

The HS code system can be pretty frustrating when you encounter it for the first time. Fortunately, with a little research and some practice, you can easily master this powerful international shipping system and start shipping your merchandise to satisfied customers from Bali to Berlin to Baltimore and beyond.

This guide gives you the breakdown on everything you need to know about the HS code system. In this guide, we will cover:

- What are HS codes?

- The HS code structure

- Why are HS Codes important?

- How to use HS codes?

- How to find the right HS codes?

- Overcoming common HS code challenges

What is HS code in shipping?

The HS code system is a set of uniform, internationally recognized codes used to identify products for import purposes. Each code consists of at least six digits, often followed by optional extra digits, that precisely identify what a product is, based on its specific features, components, purpose and other criteria.

Customs authorities check these different codes on the shipping documents accompanying imported products. They do this for a number of reasons including:

- determining tax and tariff rules that may apply for importing the products

- ensuring that the imported products are not banned due to import restrictions

- monitoring trade statistics

What make the HS nomenclature so special is that it is used by most countries in the world, including all major international retail markets. That means that the same code will enable the customs department in the US, Brazil, Australia, Sweden and practically anywhere else to identify the contents of an incoming shipment.

The code system is extremely detailed. That’s why it’s so effective. But it’s also why it can be so complicated to use when you’re still getting used to it.

Just imagine: the code system covers up to 98% of all products shipped in international commerce. When you consider how many different products there are on the global market, whether it’s jelly beans or paper cocktail umbrellas, you start to realize how extensive the HS code system is.

In short, when crossing most international borders, all products need to be identified using the right Harmonized System Code. Think of HS codes as your company’s password to entering the gate to a foreign market.

Who determines HS codes?

The HS system is governed by The International Convention on the Harmonized Commodity Description and Coding System (HS Convention). This is an international trade treaty that was adopted in 1983 and took effect in 1988, replacing previous international shipping agreements. The purpose of this treaty is to standardize international customs procedures and facilitate the movement of merchandise across international borders.

Today, the treaty has been signed by 157 ‘Contracting Parties’ (156 countries and the European Union). That means it covers most countries in the world, including all major international retail markets.

HS codes are defined and administered by the World Customs Organisation (WCO). This international authority issues an updated HS code system every five years, adding new Headings and Sub-Headings as necessary to account for new types of products entering the international market.

The World Customs Organisation also releases guidelines for how to interpret HS Codes. These help exporters determine which code actually applies to their merchandise. They also help customs authorities determine whether products have been correctly coded. It’s important for exporters to do their research and use the code that fits their product most accurately.

Are you still overwhelmed by the complicated world of international shipping? Check out our glossary where we break down many of the confusing international shipping terms.

The HS Code structure

Each HS code consists of at least six digits, usually written in the format ‘XXXX.XX’.

These six digits combine three sets of the hierarchical two-digit codes used in the HS code system. For shippers, the process of finding the right HS code for your product starts with the Section numbers.

0. HS code section numbers

There are 21 Sections to choose from when defining your product. These are very broad categories, such as Section II (‘Vegetable products’), Section V (‘Mineral products’) or Section XI (‘Textiles and textile articles’).

Important: The Section numbers help you find the correct code to identify your product, but they are not actually included in the HS code that you will write on your customs document.

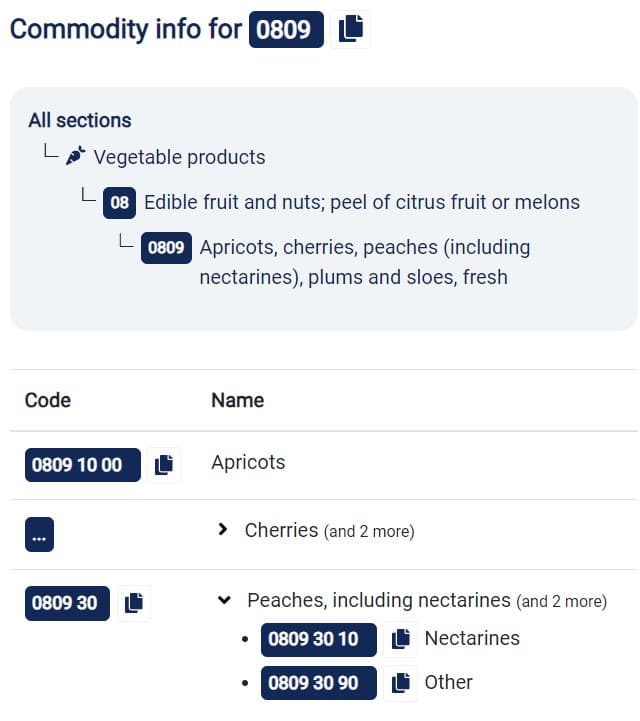

Let’s say you want to ship a crate of peaches to an international customer. To find the HS code, you’d start by choosing the right Section. In this case, it’s Section II: ‘Vegetable products’.

Once you’re in the right section of the HS code system, start narrowing down the product till you find the closest possible match to describe it. This enables you to find the right six digits that make up your product’s HS code:

1. Chapter numbers

The first two digits of the product’s HS code stand for more specific categories of products within the Sections. These different categories are known as ‘Chapters’. There are 99 different Chapters to choose from when classifying your product, spread out over the 21 Sections.

In the case of peaches, the Chapter code is 08, which stands for ‘Edible fruit and nuts; peel of citrus fruit or melons’.

2. Heading numbers

After the Chapter number, the next two digits refer to the specific ‘Heading’ that the product falls under. There are 1,244 Headings to choose from.

One heading under Chapter 08 is 09, which stands for ‘Apricots, cherries, peaches (including nectarines), plums and sloes, fresh’. Now, you’re getting closer to classifying those peaches.

3. Sub-Heading numbers

Finally, two more digits define your product even further. These final digits refer to the ‘Sub-Heading’ that your product falls under. There are 5,224 Sub-Headings in the HS nomenclature.

Under Chapter 08, Heading 09, you’ll find Sub-Heading 30: ‘Peaches, including nectarines’.

By combining all these numbers, you get the HS code for peaches: 08 + 09 + 30. This number is usually written on customs forms and commercial invoices as ‘0809.30’

4. Extra digits

When shipping to some countries, you may need to include two or more additional digits to define the product even further. For example, when shipping to the US, you will need to include additional digits from the US ‘Harmonized Tariff Schedule’ system.

These extra digits identify additional specifications about the product, which may have an influence on their tax and import status, or may simply be used by trade authorities for statistical purposes.

Which country’s tariff codes should I you use?

Since some countries use extra digits in addition to the standard six-digit HS codes, you may be wondering, which country’s codes should I use? A good guideline is: use the system that is standard for the country to which you are shipping.

Check the websites of national customs authorities to see what code systems are in place:

- For shipments to the US, you can search online for the correct codes via the U.S. International Trade Commission website, for example.

- Other countries use eight-digit code systems, such as the Mercosur Common Nomenclature (NMC) used in Brazil, Argentina, Paraguay and Uruguay.

- China uses a 13-digit system, adding a full seven extra digits to the standard HS codes.

- When shipping to EU countries or internationally within the European Union, you will use the HS code in combination with a two-digit Combined Nomenclature (CN) code, followed by a two-digit Integrated Tariff (TARIC) code.

HS Codes example

Below you can find an example of the HS code for peaches. The structure ‘0809.30’ helps identify the product clearly for international shipping and customs documentation.

Why are HS Codes important?

So, now that you know what a HS shipping code is and how to use them, you may be wondering: why are HS codes important? What difference does it make if you use the right code or not? The answer is: it makes a lot of difference, from a legal standpoint as well as from a business point of view.

Legal implications of HS codes

In most countries, it is actually the importer (the customer, in the case of e-commerce), who is responsible for ensuring their imported goods have the correct customs documentation. This includes use of the correct HS codes.

However, in practical terms, the average consumer probably doesn’t even know what an HS code or a commercial invoice is. That means the retailer has a responsibility to exercise due diligence to ensure it can fulfill its side of the sale agreement: delivering the product.

So, for all practical intents and purposes, using the correct HS code (and extra code systems) is the responsibility of the seller.

If you fail to use the right HS classifications, you and your customer may face legal consequences, including:

- Fines for non-compliance

- Seizure of merchandise by customs authorities

- Denied import

With risks like these, it’s best to be on the safe side. Always include accurate HS codes on your customs documents.

Business impact of HS code

As an online retailer, you are well aware of how important fast delivery is to your customers. Customs is one of the biggest bottlenecks in the international shipping process. That means you should do everything possible to get your package through customs more smoothly.

This is why HS codes actually help your business. By using the correct international shipping forms, along with accurate, country-specific HS and tariff codes, you speed up the international shipping process (or at least avoid unnecessary delays).

HS codes can also allow you to identify whether your merchandise is subject to additional tariffs upon arrival in the destination country. This way, you can settle those costs in advance with your customers, or at least warn customers of possible additional tariffs.

Read our blog to learn how to keep international shipping costs to a minimum while turning your customers into true fans!

How to use HS codes?

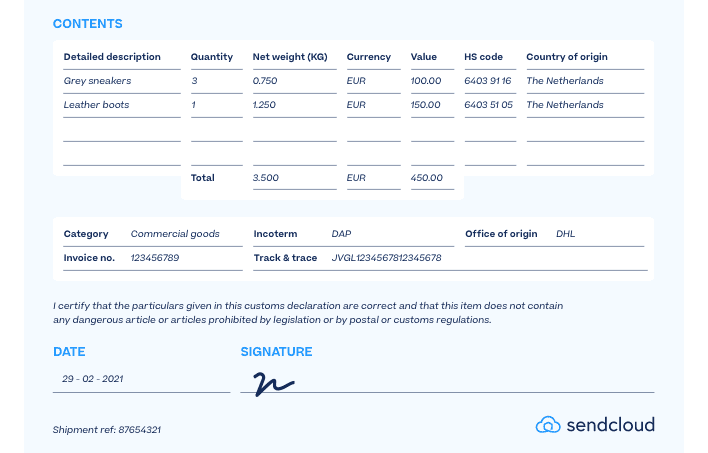

HS codes should always be included on commercial invoices or other mandatory customs documents (such as CN22 and CN23 forms). These documents are attached to the outside of your package or freight, so they are clearly visible to customs authorities.

Your package’s customs documents must contain the specific HS nomenclature for each type of product included in the shipment. Always be sure to include the full six-digits, along with any extra digits required by the destination country.

If you are in doubt about which code to use, refer to guidelines issued by your home country’s customs authorities, or get in contact with the customs authorities of the country to which you are shipping. A little extra research up front will save you a lot of hassle once your product crosses the international border.

How to find the right HS code?

The HS code system can be used to identify more than 200,000 types of products. That means finding the right code can feel like searching for a needle in a haystack.

Fortunately, you can use this handy HS Code Search Engine below to locate the HS code that best describes your product. Simply type in a detailed product name and look for the code that best applies.

Many international couriers also provide HS Code search options. Some enable you to specify the destination country, so you can access any extra digits that you need to include on your customs documentation.

Overcoming common HS code challenges

Like every aspect of international shipping, precision is key when it comes to using HS codes. The HS code list is quite baffling at first to many retailers. The good news is: (A) it becomes more transparent the more you use it, and (B) there are plenty of resources online to help steer you in the right direction.

Plus, if your online store specializes only in certain items, you’ll probably only be using a relatively small area of the HS code system anyway.

There are many challenges that can arise when using HS codes. The solution is basically always to make sure that you’re not using the incorrect code, though this can be a challenge in itself. Here are some common mistakes to keep in mind:

Avoid over-taxation due to an incorrect HS code

If you use the wrong HS code, your customer could get stuck with additional taxes and import duties that they may not actually owe. That damages your relationship with your customer and makes your products less competitive. Avoid over-taxation by always using accurate HS codes. When in doubt, reach out to customs authorities for specific guidance.

Cleared today, taxed tomorrow

In some cases, customs authorities may initially clear merchandise for entry with no questions asked. However, if they perform audits later and discover errors or discrepancies in your customs documentation, they may retroactively issue fines or levy taxes on the importer (your customer). This could lead to severe damage to your customer relations. Again, always use the right HS code to begin with, and you’ll avoid unforeseen financial burdens down the road.

Understand subtle differences

With over 5,000 Sub-Headings to choose from, the HS code system can be difficult to navigate. Often, the difference between two Sub-Headings is related to subtle differences in products. Pay close attention to the wordings of Sub-Headings. Do they specify types of packaging? Quantities per package? Be sure you choose the Sub-Heading that most accurately describes the contents of your package.

Keep up to date

Audit your own product range periodically to ensure you are still using the HS codes that fit best. Changes to ingredients, components or packaging may place your products under a different Sub-Heading. Also be sure to stick to the latest HS code list. Remember that the list is updated every five years with new regulations, so be sure to check whether the codes you are using are still valid: Here you can find the latest changes effective from 1 January 2022.

Conclusion: Using the right HS codes always pays off

While the Harmonized System may seem like a headache to international retailers, it is actually a powerful tool for getting your merchandise onto the international market. Instead of seeing the HS system as a complicated legal formality, see it as a way of making sure your products get to your customers faster.

As a result of correctly using HS codes, you’ll keep your international customers satisfied and avoid unnecessary delays and expenses.

If you’re new to the system, consult frequently with online resources to ensure you’re using the right codes. Above all, if you have any questions, check with local customs authorities in the countries where you want to do business. A little preparation and research up front will help you grow a strong international e-commerce operation in the long term.

Take the guesswork out of international shipping with Sendcloud

Navigating the complexities of international shipping can be challenging, but Sendcloud is here to help. Our HS Code Finder simplifies the process, ensuring you use the correct codes every time. This means fewer delays, less risk of over-taxation, and happier customers.

Ready to streamline your international shipping process? Try our HS Code Finder today and discover how Sendcloud can make your global e-commerce operations smoother and more efficient.

The importance of HS Codes in international shipping

The importance of HS Codes in international shipping